December 01, 2010

How are the big fallen?

I recently discussed with a colleague whether large organisations were more or less brittle than small ones. I decided to check using the Fortune 500 dataset; here are some preliminary findings.

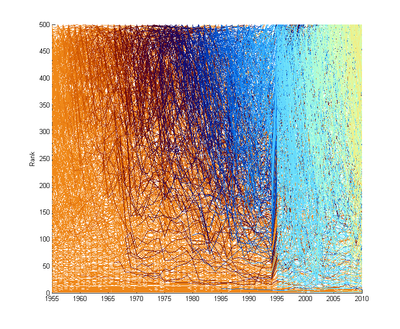

Generally the profits and revenues grow exponentially over time, so I will be looking at list rankings. Plotting them since 1955 we get the following picture:

Color denotes the year when the company appeared, low rankings are big companies. A few things are clear: there seems to be more turbulence for smaller companies than big. Something happened 1995, and I currently do not know what it is: I suspect it is an artefact, and I need to control for it. A few years later Fortune began Forune 1000, so some companies can get rankings 500-1000 (not shown).

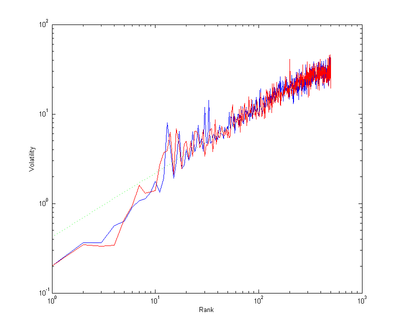

If we define a volatility measure as the sum of how many ranks companies that change rank after a year shift we get the following interesting plot of the average shift into or from different ranks (they differ because companies also appear and disappear):

The green line corresponds to the power law r0.7 - smaller companies are more volatile than bigger ones, but the relation is somewhat convex.

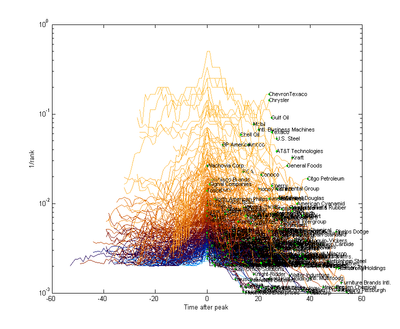

Let's plot the rank trajectories around the year the company had their best rank yet disappeared from the list before 2010 (ignoring companies with less than 20 years of data for clarity - but also a possibly biasing assumption):

The green dots are the last year of the company on the list. It is worth noting that many "disappearing" companies actually were bought up or changed into other companies, so they certainly did not all go bankrupt. Another thing to actually take into account for a proper treatment.

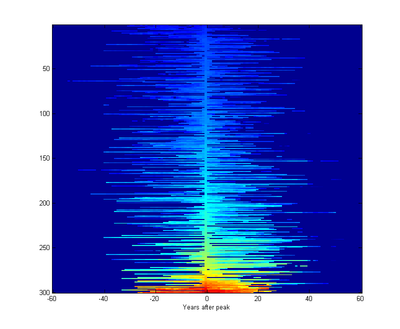

The graph looks pretty symmetric. Plotting the same data as an imagemap where each row is a company, sorted after biggest rank, makes this more clear:

There doesn't seem to be much of a trend for big companies to last much longer than small companies, at least among companies with some history.

So my preliminary conclusion - with plenty of caveats due to the rawness of the data and some filtering effects - is that big companies disappear from Fortune 500 in the same way as small ones.