March 12, 2007

Properties of Property Rights

Recently the first International Property Rights Index comparative study arrived. It is an index that measures how well physical and intellectual property rights are protected in different countries, something which ought to be very important for getting people out of poverty, as shown by Hernando de Soto's work. Since I'm fond of plotting indices, here are a few graphs.

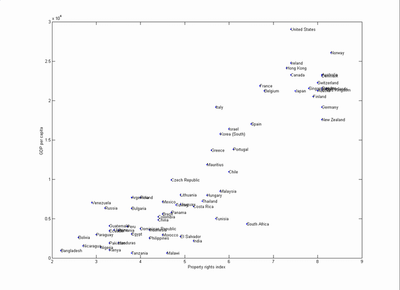

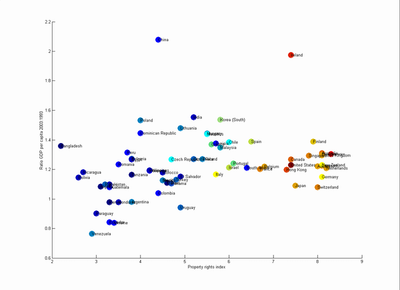

There is a clear link between GDP per capita and the IPRI: property rights are well protected in well-off countries. Italy is an interesting outlier as a rich country with an inefficient bureaucracy, while South Africa seems to be much poorer than it ought to be (perhaps due to the loss of human capital due to AIDS). Cause and effect is of course harder to see, but if we look at the GDP growth from 1993 to 2003 and assume that current property rights also reflect property rights of the last decade, we get the following diagram:

(color denotes 2003 GDP per capita)

The basic message seems to be: low protection of property rights keeps a country poor. Score one for de Soto. The effect appears to be most pronounced for IPRI < 4. In the mid- and upper range other factors are clearly important (as evidenced by the outliers China and Ireland) and the somewhat slower growth for the richest economies.

The real test would be prediction: we should expect growth rates to decline if the index decline (unless special factors like oil windfalls occur) and pick up if the index rises. Bangladesh, Nicaragua and Bolivia might be good tests; unless they protect property rights more their growth will likely plummet.

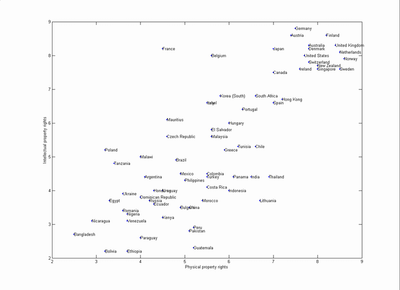

Subindices

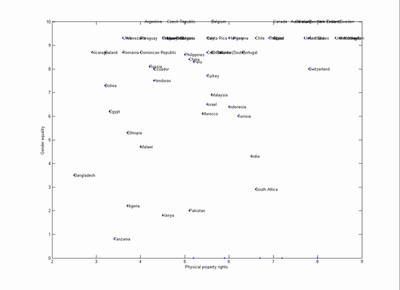

The main index is calculated from four subindices, representing the legal and political environment, physical property rights, intellectual property rights and gender equality. These in turn are calculated from other sources. The subindices are pretty well correlated with the exception of gender equality; the correlations are in the range 0.77-0.89.

Overall the countries cluster nicely, with France as a bit of an outlier with weaker physical property rights but very strong intellectual property righs (it is brought down by the hopeless system for registering property and the lack of easy loans, key factors in de Soto's theory).

The gender equality subscale correlates rather badly with the other scales, so on the positive side it contributes new information, but it might also be adding noise. Most developed countried end up with a high degree of equality, with exceptions like Switzerland and South Africa.

Other Indices

How does the IPRI compare to other indices of freedom and civil society? Note that some of the subindices are calculated from other indices, so there is a risk of automatic correlation.

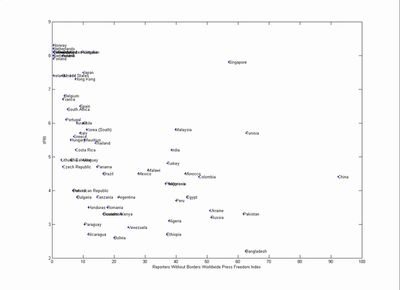

The Reporters Without Borders Worldwide Press Freedom Index produces an interesting curvilinear relationship (here low scores represent more press freedom).

Countries with less press freedom have in general less secure property rights. Even a small decrease in press freedom corresponds to a major decline in the security of property. However, there seem to be a turn around 30 as the less press free states are all over the map. It is pretty noticeable that these are the poorer per capita countries (with the exception of Disneyland-with-death-penalty Singapore). Maybe the zone around press freedom 20-30 represents an unstable state: enough press freedom to enable citizens to cause significant change if they also have safe property, forcing further press freedom.

The correlation with the Freedom House index was about 0.6, largely because of the same curving relationship (the two indices correlate to 0.86).

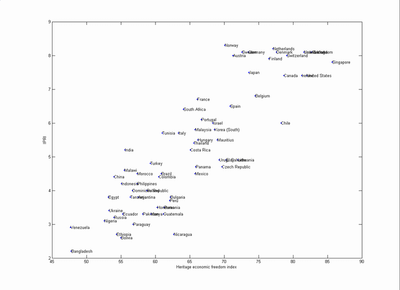

On the other hand, with the Heritage index of economic freedom has a solid 0.87 correlation with the property index. This is unsurprising, since it even includes a property rights subindex that correlates to 0.92 with the IPRI.

Summa summarum, IPRI is pretty correlated with other indices for how free societies are in a political and economical sense. Press freedom appear to be the a somewhat different kind. The equality subindex also seems pretty weakly correlated with most of the other indices, with the exception of a modest 0.51 correlation with the Freedom index.

Posted by Anders3 at March 12, 2007 11:21 PM